Making Tax Digital Submission Guide – Complete 2025 Update for the UK

The UK tax system has changed fast. Businesses must now move from paper records to digital systems. This Making Tax Digital Submission Guide explains everything in clear steps. It helps you follow HMRC rules without stress. This guide covers VAT, Income Tax, Corporation Tax, and record-keeping rules.

This digital tax filing guide targets businesses, landlords, and accountants. It supports full compliance and reduces tax errors.

What is Making Tax Digital?

Making Tax Digital (MTD) is a UK government programme. It requires businesses to keep digital records and file tax online. The goal is simple. Reduce errors and speed up tax reporting.

This Making Tax Digital Submission Guide helps you understand all core rules. It includes software requirements, deadlines, and practical tips.

Our Making Tax Digital 2025 guide explains everything you need to know about the new HMRC requirements. Link

MTD improves tax management:

- Accurate data

- Immediate access to tax information

- Faster submissions

- Reduced penalties

MTD changes the old system forever.

Learn how to complete your Making Tax Digital submission quickly and accurately

✅ Who Must Follow This Making Tax Digital Submission Guide?

You must follow MTD rules if you are:

| Category | Requirement |

| VAT-registered businesses | Must use MTD software for VAT |

| Self-employed earning above threshold | Must file digital tax returns |

| Landlords earning above threshold | Must keep digital property income records |

| Partnerships | Full requirements coming soon |

| Limited companies | Will join MTD for Corporation Tax later |

This MTD guide supports all groups through each compliance step.

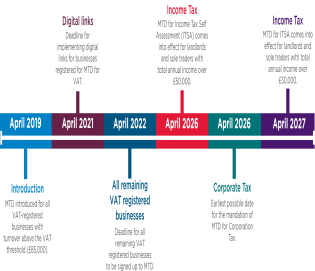

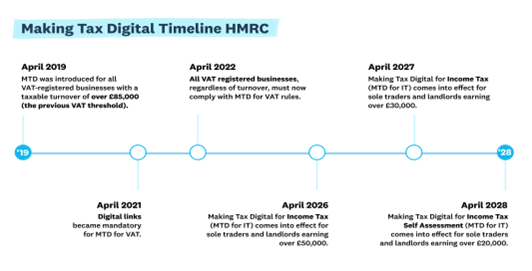

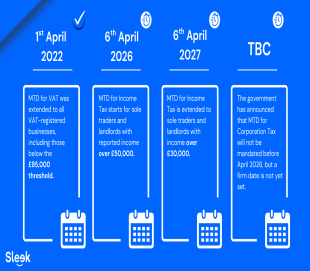

Key Deadlines You Must Know

The schedule continues to expand. This timeline simplifies future changes.

| Rule | Effective Date |

| VAT for all registered businesses | Started April 2022 |

| MTD for Income Tax (ITSA) | April 2026 onward |

| Corporation Tax MTD | Future rollout date pending |

This Making Tax Digital Submission Guide keeps these deadlines in focus. Always check for updates from HMRC.

Stay compliant with HMRC Making Tax Digital rules and deadlines

Why HMRC Requires Digital Tax Submissions

The UK lost billions from tax mistakes every year. Digital systems fix that problem.

Benefits for you:

Benefits for you:

- No handwritten errors

- Clear digital records

- Faster HMRC approval

- Better tax visibility

- Easy business planning

This digital tax filing guide gives practical ways to use those benefits.

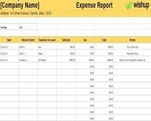

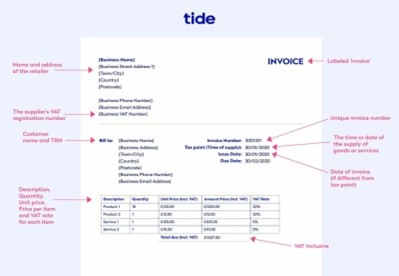

What Digital Records Must You Keep?

Our step-by-step guide to digital tax returns UK simplifies the process

You must keep business data in approved digital form:

- Sales and revenue

- Purchase invoices and receipts

- VAT details for every transaction

- Business expenses proof

- Property income if you are a landlord

This Making Tax Digital Submission Guide shows the right storage formats and tools.

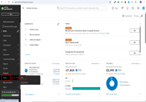

Approved Software for MTD Submissions

Approved Software for MTD Submissions

You must use compatible software. Spreadsheets alone are not enough.

Recommended apps:

- Xero

- QuickBooks

- Sage

- FreeAgent

- Zoho Books

- Making Tax Digital bridging software

The MTD guide works with every approved tool. Check HMRC for updated lists.

For Any query we are available here

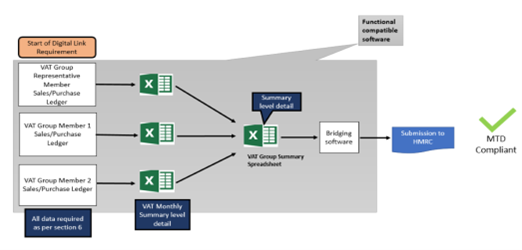

Step-by-Step Making Tax Digital Submission Guide for VAT

Follow this action plan:

Step 1: Check VAT registration

Ensure VAT threshold applies to your business.

Step 2: Choose compatible software

Connect your digital records system.

Step 3: Sign up for MTD with HMRC

Use your Government Gateway account.

Step 4: Keep ongoing digital records

Record each transaction with correct VAT codes.

Step 5: Submit VAT returns through software

Submit once every three months normally.

Step 6: Save confirmation from HMRC

Keep it for your audit trail.

This Making Tax Digital Submission Guide keeps VAT filing quick and simple.

Income Tax Under MTD (ITSA)

This change impacts millions of individuals and landlords.

You must:

- Submit quarterly updates

- Keep property or business income digital

- Send a final annual declaration

This digital tax filing guide reduces surprise tax bills.

Penalties for Not Following MTD Rules

Tax compliance is mandatory. HMRC now uses point-based penalty rules.

- Missing deadlines earns penalty points

- Repeated failures cause fines

- Incorrect submission may trigger compliance checks

This Making Tax Digital Submission Guide keeps businesses safe from penalties.

How to Prepare Your Business for MTD Success

Discover the latest updates to MTD for VAT 2025

Follow these important actions:

- Train staff on new software

- Move old paper records into digital form

- Review VAT processes

- Track deadlines

- Store backup copies

Good preparation saves time and money.

Using an Accountant or Bookkeeper for MTD

MTD helps professionals offer more value. They monitor digital data in real time.

Benefits of hiring a professional:

- No stress filing

- Faster corrections

- More tax-saving advice

- Peace of mind

This Making Tax Digital Submission Guide supports accountants too.

Cybersecurity and Record Protection

Digital systems require good security.

Use safe practices:

- Secure passwords

- Encryption where possible

- Cloud software backups

- Strong user permission controls

This MTD guide encourages professional data care.

Making Tax Digital Submission Guide for Landlords

Landlords are joining MTD for Income Tax. They must report property income.

The process is simple:

- Link property income to software

- Upload receipts digitally

- Send quarterly income updates

- Submit the final declaration annually

Landlords gain stronger record-keeping with this digital tax filing guide.

Small Business Advantages with MTD

Small firms benefit most from modern systems.

📌 Advantages:

- Clear performance indicators

- Safer financial planning

- Professional bookkeeping

- Automated reports

This Making Tax Digital Submission Guide explains how MTD boosts growth.

Real-World MTD Example: VAT Submission Workflow

A typical VAT workflow:

- Enter invoices in software

Categorise VAT correctly

Reconcile bank feeds

Review VAT report

Submit return directly to HMRC

Receive instant receipt

This Making Tax Digital Submission Guide supports repeat success each quarter.

Common MTD Mistakes to Avoid

Avoid these issues:

- Manual corrections outside software

- Missing deadlines

- Incomplete digital records

- Wrong VAT codes

- Weak cybersecurity

This MTD guide saves time and prevents penalties.

Future of Digital Tax in the UK

Expect more automation and less paperwork. MTD builds an efficient digital economy. Software will handle complex tasks soon. Accountants will give advice instead of chasing receipts.

This Making Tax Digital Submission Guide keeps you ready for every change.

Final Checklist: Stay Compliant with This Making Tax Digital Submission Guide

✔ Keep digital records always

✔ Use software approved by HMRC

✔ Track VAT and income deadlines

✔ Submit reports directly through software

✔ Store confirmation receipts

✔ Protect data with strong security

✔ Review records regularly

✔ Seek professional support if needed

This digital tax filing guide ensures full compliance without stress.

Need Help With Digital Tax Filing?

You do not need to face MTD alone. Many small businesses struggle with setup. Professional support ensures fast and correct submissions.

Our goal is simple. Help you submit MTD returns correctly every time.

Your Making Tax Digital Submission Guide for a Smooth Future

Your Making Tax Digital Submission Guide for a Smooth Future

This Making Tax Digital Submission Guide gives you full confidence. It explains every step from registration to submission. With correct software and preparation, tax compliance becomes simple.

Digital filing is the future. Start now and enjoy smoother business operations.

Our step-by-step guide to digital tax returns UK simplifies the process.

As the UK government continues its journey toward full digitalisation of the tax system, Making Tax Digital (MTD) has become more than just an initiative — it’s now a vital part of how businesses and individuals manage their tax obligations. Whether you’re a small business owner, a landlord, or an accountant supporting clients, understanding the Making Tax Digital 2025 updates is essential to staying compliant and efficient in the modern tax landscape.

As the UK government continues its journey toward full digitalisation of the tax system, Making Tax Digital (MTD) has become more than just an initiative — it’s now a vital part of how businesses and individuals manage their tax obligations. Whether you’re a small business owner, a landlord, or an accountant supporting clients, understanding the Making Tax Digital 2025 updates is essential to staying compliant and efficient in the modern tax landscape.

What Is Making Tax Digital?

Making Tax Digital (MTD) is a government initiative introduced by HMRC to modernise the UK tax system. Its main goal is to make tax administration more effective, efficient, and easier for taxpayers by replacing manual record-keeping and paper-based submissions with secure, digital processes.

Under the HMRC Making Tax Digital system, businesses must maintain digital records and submit their returns using MTD-compatible software. This move helps to reduce errors, improve record accuracy, and ensure that tax is calculated correctly the first time.

If you’re still unsure whether you fall under the new rules, visit our Making Tax Digital 2025 guide for a full overview of eligibility and exemptions.

Who Needs to Comply in 2025?

Since April 2022, all VAT-registered businesses — regardless of turnover — have been required to file VAT returns through MTD for VAT. However, 2025 brings a wider rollout, extending MTD obligations beyond VAT to include Income Tax Self-Assessment (MTD for ITSA).

This means:

-

Self-employed individuals and landlords earning more than £50,000 annually must join MTD for Income Tax from April 2026, while those earning between £30,000 and £50,000 will follow in April 2027.

-

However, 2025 is the final preparation year, making it crucial to get your digital systems in place now.

Our Making Tax Digital deadlines 2025 page explains the timeline in full, including the transitional steps HMRC expects businesses to complete this year

Conclusion: Your Making Tax Digital Submission Guide for a Smooth Future

Making Tax Digital 2025 marks the next big step in the UK’s tax revolution. The shift to digital submission isn’t just about meeting HMRC’s requirements — it’s about empowering business owners with clarity, control, and confidence over their finances.

Whether you’re submitting a VAT return, preparing for MTD for Income Tax, or simply upgrading your software, the key is to start now. Visit our Making Tax Digital support page for expert help, tutorials, and resources designed to keep your business compliant and stress-free.

Benefits for you:

Benefits for you: