Abolition of the Non-Dom Regime: What It Means for UK Residents and Expats in 2025/26

What was the non-dom regime?

The non-dom regime allowed UK resident, non-UK domiciled individuals to choose the remittance basis. Under the remittance basis they were taxed on UK-source income and gains, but only on foreign income and gains if brought (“remitted”) into the UK. (Norton Rose Fulbright)

Additionally, non-doms often enjoyed favorable treatment under UK inheritance tax (IHT) rules regarding overseas assets. (BDO UK)

This longstanding tax regime has now been abolished and replaced with a residence-based system. The shift will affect many current and future UK tax residents.

What Was the UK Non-Dom Regime and Why It Mattered

The non-domiciled (non-dom) tax regime allowed UK residents who were not UK-domiciled to use the remittance basis of taxation. This meant they paid UK tax only on domestic income and gains, while foreign income was taxable only when remitted to the UK.

This system offered unique advantages — including reduced exposure to UK inheritance tax (IHT) on overseas assets. However, the landscape has changed. The abolition of the non-dom regime introduces a new residence-based taxation model, significantly affecting globally mobile individuals.

Why is the non-dom taxation regime being abolished?

The UK government’s motive for abolishing the non-dom tax status is three-fold:

- To simplify the tax regime by eliminating “domicile” as a driver of tax liability. (GOV.UK)

- To create a tax system where longer-term UK residents are taxed on worldwide income and gains rather than enjoying special perks. (GOV.UK)

- To generate additional tax revenue and eliminate what was viewed as preferential treatment for certain taxpayers. (Perkins Coie)

Key changes under the new regime

Here are the essential reforms that replace the non-dom regime and remittance basis:

-

End of the remittance basis for new foreign income and gains

From 6 April 2025, foreign income and gains (FIG) arising after that date will not be eligible for the remittance basis. UK residents will, in most cases, be taxed on worldwide income and gains as they arise. (haysmac.com)

-

New “Foreign Income and Gains” (FIG) relief for qualifying newcomers

Individuals arriving in the UK after 6 April 2025 who have not been UK tax resident for the preceding ten tax years may claim a four-year relief period. During those first four years they may enjoy full relief on foreign income and gains even if remitted to the UK. (GOV.UK)

-

Transitional relief for existing non-doms / remittance basis users

For those who have used the remittance basis prior to 6 April 2025, transitional measures apply:

- A Temporary Repatriation Facility (TRF) allows unremitted FIG from before that date to be designated and taxed at reduced rates: 12% for 2025/26 and 2026/27, 15% in 2027/28. (Norton Rose Fulbright)

- Capital gains tax (CGT) rebasing may apply for assets held personally on 5 April 2017 by remittance-basis users. (GOV.UK)

-

New residence-based IHT exposure

The domicile-based inheritance tax regime is being replaced by a residence-based test. From 6 April 2025, long-term UK residents may be liable to IHT on their worldwide assets if they’ve been UK resident for ten of the previous twenty tax years. (www.rossmartin.co.uk)

Why the UK Government Abolished the Non-Domiciled Tax Regime

The end of the non-dom regime aims to modernise the tax system and ensure fairness across taxpayers. The UK government’s main objectives include:

-

Simplifying taxation by removing “domicile” as a key factor in tax residency.

-

Ensuring long-term UK residents pay tax on worldwide income and gains.

-

Raising more tax revenue and closing loopholes previously available to wealthy expats.

This reform represents one of the biggest UK tax changes in 2025/26, shifting the focus firmly from domicile to residence.

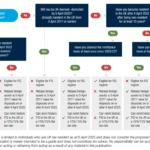

Who is impacted and when?

Current UK residents with non-dom status

If you are UK resident and non-UK domiciled, the changes mean either:

- You may qualify for the FIG regime if you meet the ten-year non-residence test and elect in time.

- Or you may become liable to UK tax on your foreign income and gains from 6 April 2025 under the new residence-based framework. The old remittance basis will no longer protect future income/gains.

New arrivals to the UK

If you intend to become UK tax resident after 6 April 2025 and have not been UK resident for the prior ten tax years, then you may qualify for the four-year FIG relief. This creates a planning opportunity.

Individuals with offshore trusts or foreign assets

Existing protections for foreign trusts and income/gains held offshore are diminished. For trust structures settled by non-doms, the removal of trust “protections” is a key change. (CRS)

Planning implications: What you should do now

Audit your worldwide income and gains

With the shift to a residence-based regime you should map out all foreign income and gains and their timing. Future realisations should be carefully timed.

Assess eligibility for the FIG relief

If you are considering UK residence, check whether you qualify for the four-year FIG regime. If you arrive timely and claim the relief, it can offer significant tax headroom.

Consider the TRF option

If you are a former remittance basis user, evaluate whether using the TRF to bring pre-6 April 2025 foreign income/gains into the UK at reduced tax is advantageous. But note timing, rates and conditions matter.

Review trust structures and offshore entities

If you have offshore trusts or companies, assess how the new rules affect you. Protection previously available under non-dom status is largely removed for many.

Update your estate planning

Since the IHT regime is moving to residence-based, long-term UK residents must review exposure for worldwide assets. Estate plans that assumed the old domicile rules may now be inadequate.

Why these reforms matter for UK residents and expats

-

Broader tax exposure:

Individuals may face UK tax on foreign income and gains sooner and more comprehensively than under the old non-dom regime.

-

Greater planning complexity:

Although simplification is an objective, the transitional reliefs and new reliefs create complex choices and timing decisions.

-

Residence decisions become critical:

The number of years of UK residence, past non-residence status, and timing of arrival/departure now have greater importance.

-

Offshore structures and trust planning impacted:

The new rules erode some of the advantages non-doms previously had, making structural reviews essential.

What this means in the 2025/26 tax year

In the tax year 2025/26 (6 April 2025 to 5 April 2026), the first full year under the reformed regime:

- If you are a UK resident non-dom and do not qualify for the FIG relief, you will be taxed on worldwide income and gains arising on or after 6 April 2025.

- If you are a new arrival and do qualify for the FIG relief, you may elect in the 2025/26 year and enjoy relief on foreign income/gains for that tax year (and potentially the next three years).

- If you have pre-6 April 2025 foreign income/gains unremitted and were a remittance-basis user, you may consider using the TRF during this period to remit at reduced rates.

Action checklist for your tax planning

-

Map your global income and gains

– identify foreign sources, timing and future realization.

-

Check your residence history and future residence plans

– do you qualify for the FIG relief?

-

Evaluate use of the TRF

– if you’ve got unremitted foreign income/gains from before 6 April 2025 and were using the remittance basis.

-

Review trust and offshore entity arrangements

– old structures may no longer provide the same benefits.

-

Update estate planning and IHT exposure

– long-term UK residence means worldwide assets may fall within UK IHT.

-

Seek specialist advice now

– deadlines, elections (like FIG claim) and filing mechanics are time-sensitive.

Why you should act now

The abolition of the non-dom regime is one of the most significant UK tax reforms in recent decades. Delay may mean missing out on reliefs, being unaware of tax exposure, or facing compliance headaches. For current UK residents, expats, international individuals with UK links or offshore wealth, timely planning ahead of 2025/26 is essential.

Who Will Be Affected by the Abolition of the UK Non-Dom Regime?

Impact on Current UK Residents with Non-Dom Status

Existing non-doms who live in the UK will lose remittance-basis protections and will likely face UK taxation on global income and gains starting April 2025.

Those who meet eligibility for the FIG regime may still claim limited relief.

Impact on New Arrivals and Returning Expats

If you become UK resident after April 2025 and haven’t been resident for ten prior years, you could claim four-year FIG relief.

This presents a valuable opportunity for expats relocating to the UK to plan income streams efficiently.

Impact on Offshore Trusts and Foreign Assets

Protections for non-dom trusts are being removed.

Individuals with offshore structures should seek immediate professional advice, as foreign trusts and companies may now face full UK tax exposure.

Tax Planning After the Abolition of the Non-Dom Regime

1. Audit Your Worldwide Income and Gains

Map all foreign income, assets, and gains. Understand how the timing of realisations impacts your future UK tax liability.

2. Assess Eligibility for FIG Relief

If you’re considering UK residency, review your history to determine if the four-year relief period applies.

3. Consider Using the Temporary Repatriation Facility (TRF)

Evaluate the benefit of remitting pre-April 2025 foreign income/gains at discounted rates — but act before the deadlines.

4. Revisit Offshore Structures

Trusts and companies abroad that relied on non-dom protections will need restructuring to avoid unnecessary exposure.

5. Update Estate and Inheritance Planning

Residence-based IHT changes mean worldwide assets could fall under UK inheritance tax.

Reassess estate plans now to stay compliant and minimise liabilities.

Why the UK Non-Dom Abolition Matters for Expats and High-Net-Worth Individuals

The abolition of the non-dom regime is a watershed moment for tax planning.

Its effects include:

-

Expanded UK tax exposure for residents and expats.

-

Complex new transitional and relief options (FIG, TRF).

-

Increased importance of residence history in tax determination.

-

Reduced protection for offshore trusts and investments.

End of the Non-Dom Regime: Key Tax Changes from April 2025

1. Ending the Remittance Basis of Taxation

From 6 April 2025, foreign income and gains (FIG) will no longer qualify for the remittance basis.

UK tax residents will be taxed on worldwide income as it arises, not only when brought into the country.

2. Introduction of Foreign Income and Gains (FIG) Relief

New UK arrivals can benefit from four years of FIG relief, provided they have not been UK tax resident for the previous ten years.

This foreign income and gains exemption applies even if the income is remitted to the UK — offering short-term flexibility for international movers.

3. Transitional Relief for Existing Non-Doms

Those who previously claimed the remittance basis can access transitional reliefs to ease into the new system:

-

A Temporary Repatriation Facility (TRF) allows pre-April 2025 foreign income and gains to be remitted at discounted tax rates (12% in 2025/26, 15% in 2027/28).

-

Capital Gains Tax (CGT) rebasing for assets held before 5 April 2017 can reduce future CGT exposure.

4. Shift to Residence-Based Inheritance Tax (IHT)

From April 2025, inheritance tax will be determined by UK residence rather than domicile.

Long-term residents (10 of the past 20 tax years) will face IHT on worldwide assets — a significant change from prior domicile-based rules.

Conclusion

The end of the non-dom tax regime marks a clear shift from domicile-based tax privileges to a residence-based tax framework. For many UK residents and expats, this means increased scrutiny on foreign income, gains and offshore structures. At the same time, new arrivals who qualify for the four-year FIG regime have a transitional window of planning opportunity.